1500 paycheck after taxes

1500 a month after tax breaks down into 18000 annually 34498 weekly 6900 daily 863 hourly. 1500 after tax breaks down into 12500.

Algebra 2 Section 5 2

2875 weekly 575 daily 072 hourly NET salary if youre working 40 hours per week.

. How much is 1500 a week after tax. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. How Your Texas Paycheck Works.

1500 a month after tax is 1500 NET salary based on 2022 tax year calculation. Then enter your current payroll information and. 1500 after tax is 1500 NET salary annually based on 2022 tax year calculation.

This calculator helps you determine the gross paycheck needed to provide a required net amount. That equates to a yearly salary of 62400 or a monthly rate of 5200. Tax example for 1500 using the Austrlia Tax.

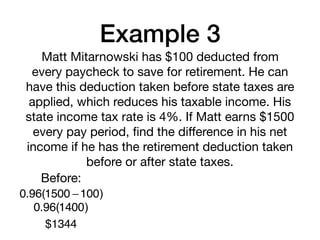

To easily divide by 100 just move the decimal point two spaces to the left. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld.

For example if an employee earns 1500 per week the individuals. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. How much is 1500 a week after tax.

Money you contribute to a 401k is pre-tax which means the contributions come out of your paycheck before income taxes are removed. Firstly divide the tax rate by 100. 15k after tax Salary and tax calculation based on 202223 ATO tax rates and tax calculations - Full income tax and medicare deductions.

Federal income taxes are also withheld from each of your paychecks. Rates remain high in Melbourne where median weekly earnings top 1200. 75100 0075 tax rate as a decimal.

In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also. It depends as the IRS uses one of two methods.

After taxes and other deductions a. What are the taxes on 1000 paycheck. The advantage of pre-tax contributions is that.

It can also be used to help fill steps 3 and 4 of a W-4 form. That means that your net pay will be 43041 per year or 3587 per month. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

How Your New Jersey Paycheck Works. For starters all Pennsylvania employers will. Now find the tax value by multiplying.

Your employer uses the information that you provided on your W-4 form to. First enter the net paycheck you require. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Avanti Gross Salary Calculator

Avanti Gross Salary Calculator

Avanti Gross Salary Calculator

New York Paycheck Calculator Smartasset

2

Printable Checks Payroll Template Payroll Checks

Avanti Gross Salary Calculator

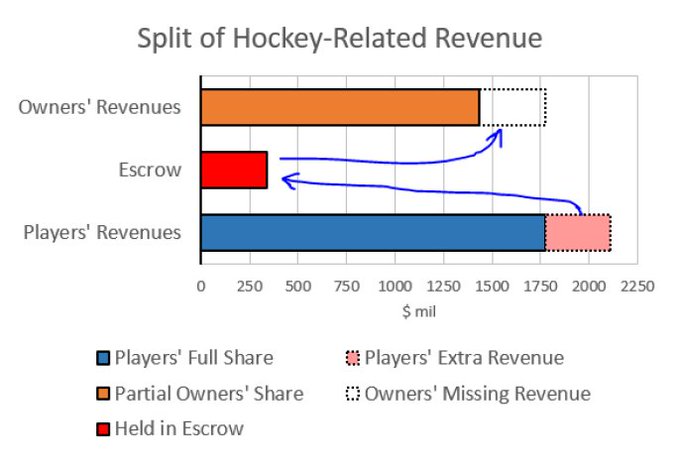

Nhl Chris Pronger Explains How Much Money Nhl Players Actually Make

Avanti Gross Salary Calculator

Salary Taxes Social Security

133 418 Check Payment Images Stock Photos Vectors Shutterstock

Personal Finance Fundamentals Course Compound Confidence

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2

Avanti Gross Salary Calculator

Avanti Gross Salary Calculator

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate